The Best Mortgage Calculator in Canada

Featured by Apple, CBC News, the Financial Post as well as many others, the Canadian Mortgage App has more than 10,000 five star reviews and is the best mortgage calculator in Canada.

From Real Estate Investors to First-Time Home Buyers

Whether you’re thinking about buying a house, condo or a townhouse, starting the journey to homeownership can be overwhelming and stressful.

Before going deeper into more details and reviewing this fantastic mortgage calculator app, let me quickly explain a couple of basic terms you will keep coming across when looking for condos or houses for sale

What is a Mortgage?

A mortgage refers to the home loan that the lenders (Mortgage Bankers, Mortgage Brokers, and Wholesale Lenders) provide to you for the purchase of a property (Real Estate).

A mortgage rate is divided into two parts: Principal, which refers to the amount of money being borrowed and Interest, which is the cost of borrowing from the lender.

If you want to avoid foreclosure (Lender takes possession of a mortgaged property), don´t miss your payments.

What is a Mortgage Calculator?

A mortgage rate calculator is a tool that will help you know how much your monthly payments will be for a house of a given price.

No te Pierdas todos mis TRUCOS en para AHORRAR DINERO

¿Quieres tener Healthy Pockets?

Canadian Mortgage App

The Best Mortgage Calculator for Canadians

Whether you are a first-time home buyer or a Real Estate Investor, you´ll probably be wondering: «How much can I afford?» Looking for an answer to this question is how I found this App a few months ago.

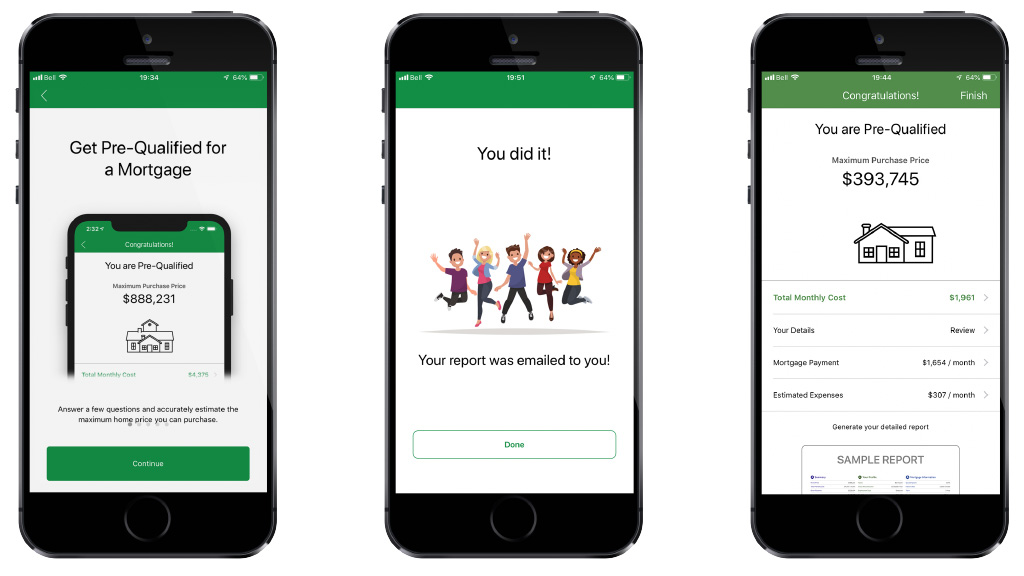

Imagine being able to know how much money a bank would lend to you from the convenience of your smartphone, with completely accurate results in less than 5 minutes!

The Canadian Mortgage App will do that for you and much more! Lets go step by step through the 3 main features the Canadian Mortgage app offers for home buyers:

1. Get Pre-Approved for a Mortgage

You are navigating through a real estate website looking for houses for sale and suddenly you find the house of your dreams and think, what do you have to do next?

Download the app if you haven´t already done so!

The Canadian Mortgage App offers a super easy and user friendly interface. In just 10 steps, entering some basic information you will be able to know what’s the maximum price that you can afford for a house.

What Information do you Need to Know?

In order to get pre-approved for a mortgage, you should know and have ready all of this information beforehand.

- Which province and city do you want to buy the property?

- Are you buying a Condo or a House?

- Are you planning either full or partial rental of the property?

- How much money would you put as a downpayment?

- Do you have Credit card debt, a line of credit, car loan or other any other kinds of loans?

- What is your employment status?

- What is you gross anual income?

- Do you know your credit score?

After you finish entering all your information, you will receive a detailed report in your email as well, and what is even better, this check won’t have any impact in your Credit Score!

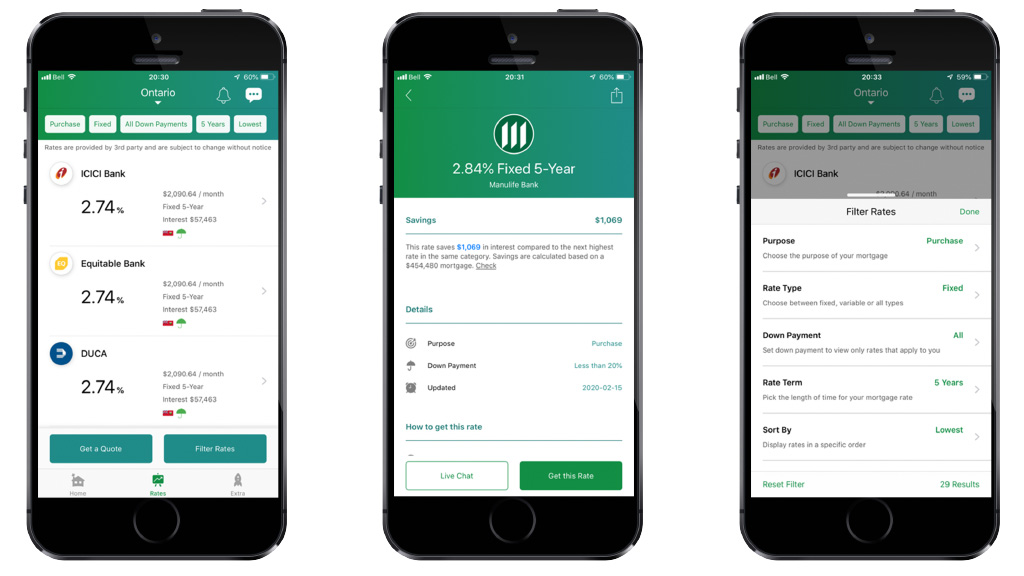

2. Pick Between the Best Terms & Rates

Now it’s time to find the best mortgage rates! Once you get pre-approved, the Canadian Mortgage App will offer you a full variety of terms and rates as well as specific information about every lender.

What is a Mortgage Term?

The term of a mortgage is the length of time a lender will loan mortgage funds to a borrower. Duration of the terms in Canada can be from 6 months to 10 years, with the most common being from 2 to 5 years. Important to know: “Usually, the shorter the duration of a mortgage term, the lower the interest rate, and the less it costs to borrow the money from the lender”.

Short Term

- Short term mortgage contracts are generally for two years or less.

- They offer a lower interest rate than a longer term.

If you believe that interest rates are currently higher than they will be in the near future, I would recommend that you choose a short term mortgage.

Long Term

- Long term agreements are usually 3 years or more.

- The interest rate will be higher than short-term mortgages.

If you are looking for stability and have fixed expenses over a set period of time, a long term mortgage would work for you.

The flexibility is perfect if you see it this way: “Different kinds of mortgages to fit the needs of different types of people”

What is Interest Rate?

It´s the amount of interest charged on a loan, expressed as a percentage. Interest rates are usually lower when you borrow money for a short period of time and higher if you do it for a long period of time.

Fixed Mortgage Rate

If you decided to pick a fixed rate mortgage, your interest rate won’t change during the term of your mortgage. These is the best way to avoid surprises since you are going to know how much your payments are going to be and how much of your of your principal will be paid off at by the end of the term.

Variable Mortgage Rate

However if you decided to pick a variable rate mortgage, interest rates would fluctuate with the bank’s prime lending rate, and may vary from one month to another.

When interest rates change, your payment amount would remain the same, however, the amount that is applied to the principal would change.

The variable rate mortgage is the perfect option for home buyers who believe that interest rates are currently high and will drop.

As you can see in the image above, you would be able to configure the search so you can pick the terms and rates that better suit your needs. Whether you want to purchase a house for your family, refinance your current one, or buy an investment property, you are going to be able to pick the type of interest (fixed or variable) as well as the length of your mortgage (short or long term).

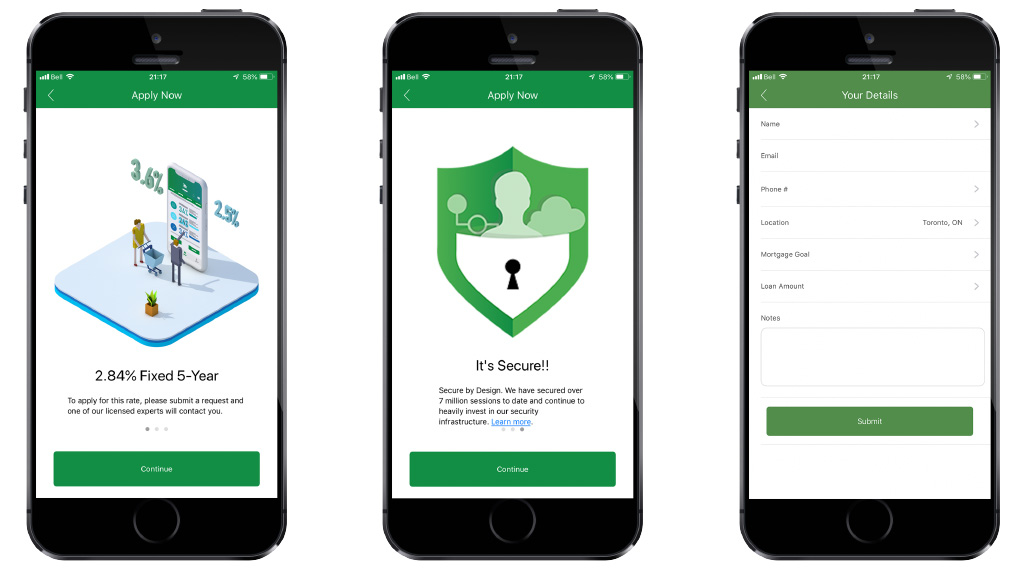

3. Apply from your Phone

Last but not least, when you are ready to submit your mortgage to a licensed broker, you are going to be able to do it directly from your phone and just sit and wait for them to contact you back. Yes it’s as simple as that!

What are the Closing Costs?

Appraisal Fee

Payment made to someone who evaluates how much your home is worth. It is essentially a fee to estimate the value of your property.

Deposit

In Real Estate it´s the amount of money that you as a buyer give to the seller to confirm agreement and commitment of the purchase of a home.

Down Payment

A partial payment of the property made at the time of purchase. As a First-time home buyer you would be able to participate in Incentives and Government programs.

Home Inspection Fee

The fee that a licensed property inspector charges for determining the current physical condition of the property. This step is really important in order to avoid any problems or expenses after the purchase.

Land & Property Taxes

A tax paid on property that changes hands. In Canada, First-time buyers may be eligible for a rebate depending on the province.

Legal Fees

Charges paid to a lawyer, associated with the sale or purchase of a property, these include costs for searching, drawing and registering the mortgage documents.

Mortgage Loan Insurance

Mortgage loan insurance enables homebuyers to purchase a home with as little as 5% down payment. This amount depends on the total amount borrowed from the lender.

And finally If you are a Real Estate Agent or a Real Estate Broker this app is also for you! I will review their own features in upcoming posts, but if you cannot wait to know more about them click on the following links:

I would like to finish saying that as an active user of the Canadian Mortgage App, I would rank it as the best mortgage calculator in Canada as well as one of my favorites Personal Finance apps.

¡Descarga tu plantilla gratuita para gestionar tus finanzas!

Save to Invest & have Healthy Pockets